By Taylor Brandon, Allison Dukes, Hannah Evans, Laila Henderson, Braden Overby

“Come in or don’t get paid” was the mantra of Brittney Barnes’ employer. During the pandemic, Barnes’ Mississippi boss made it clear that she was expected to work whether she was “sick or not,” Barnes told the Youth Media Project. The attitude of her boss left her company’s employees feeling unappreciated, but at the time it was not enough to make Barnes leave her position because she was determined to earn enough money to support herself and her two children.

Originally from Greenville, Miss., Barnes had moved to Ridgeland with her then-5-year-old daughter in 2014 to take advantage of the variety of jobs and better pay in the Jackson metro, and at the time, a job offer from her soon-to-be employer seemed like a dream come true. Barnes became a licensed sales professional, eventually landing a position at the company after she met her boss at a grocery store. They struck up a conversation, and Barnes’ boss soon gave her the job offer upon finding out her credentials.

Her employer was a stern, African American woman in her 60s. During her time at the office, Barnes and her colleagues rarely got breaks or days off, she said, and many of the workers left.

Despite her later negative experiences, Barnes said, “I loved that job.”

It was in the field she desired, and the pay was enough to keep her afloat. So Barnes put up with the work conditions and walked through the small waiting room of the suite to her desk, where she took calls day in and day out. She eventually had another child and was mostly stable at her job—until COVID-19 struck.

During the pandemic, the company began laying off many employees. Barnes knew it would not be long before she was let go, so she urgently searched for another job. At the time, the federal Child Tax Credit, or CTC, was expanded as part of the American Rescue Plan Act of 2021 to aid parents whose jobs were affected. Before 2021, Barnes would get a tax refund of more than $3,200 for her children at the end of the year. When the CTC was expanded during the pandemic, Barnes began getting monthly payments, allowing her to stay financially afloat.

“With the monthly payments that they were giving for people who lost their job or whose hours were cut, that’s how they survived,” Barnes said in an interview. “It gave you some security of knowing that every single month—if you were short on a bill or you had to go and get some food—that you knew that it was coming.”

Barnes was able to switch jobs to ADT Security, which allowed her to work from home. The CTC also helped Barnes make the swap, as she was able to put the extra money toward other expenses, especially for her children. “(The first payment) was right before back-to-school, so it was a big help. (I’m) very thankful,” she said.

The payments even allowed Barnes to invest in her children’s schooling and their futures. “At that time, I was able to take the child tax credits and put it into a savings account for them,” she said.

Barnes’ two children, 8-year-old Mason and 15-year-old Maya, were pleased when they saw their mother was doing better for herself. Before, they knew not to ask for too much as they were aware of their mother’s situation. “They never expect anything, but they definitely knew when things got a whole lot better,” Barnes said.

Since the end of the pandemic-era CTC program in December 2021, Barnes has hoped that the higher credits will return so that she will have the adequate support she needs for her family. For now, Barnes is hard at work on her master’s degree so that she can hopefully provide that support herself.

What is the Child Tax Credit?

The Child Tax Credit was a part of the American Rescue Plan of 2021. The plan, also known as the COVID-19 Stimulus Package, was a $1.9 trillion economic stimulus bill, which Congress passed, and President Joe Biden signed into law on March 11, 2021. The American Rescue Plan Act’s purpose was to speed up the country’s recovery from the economic downturn that resulted from the COVID-19 pandemic. The CTC gave $2,000 per child to parents who have children aged 6-17 and $3,600 per child under age 6.

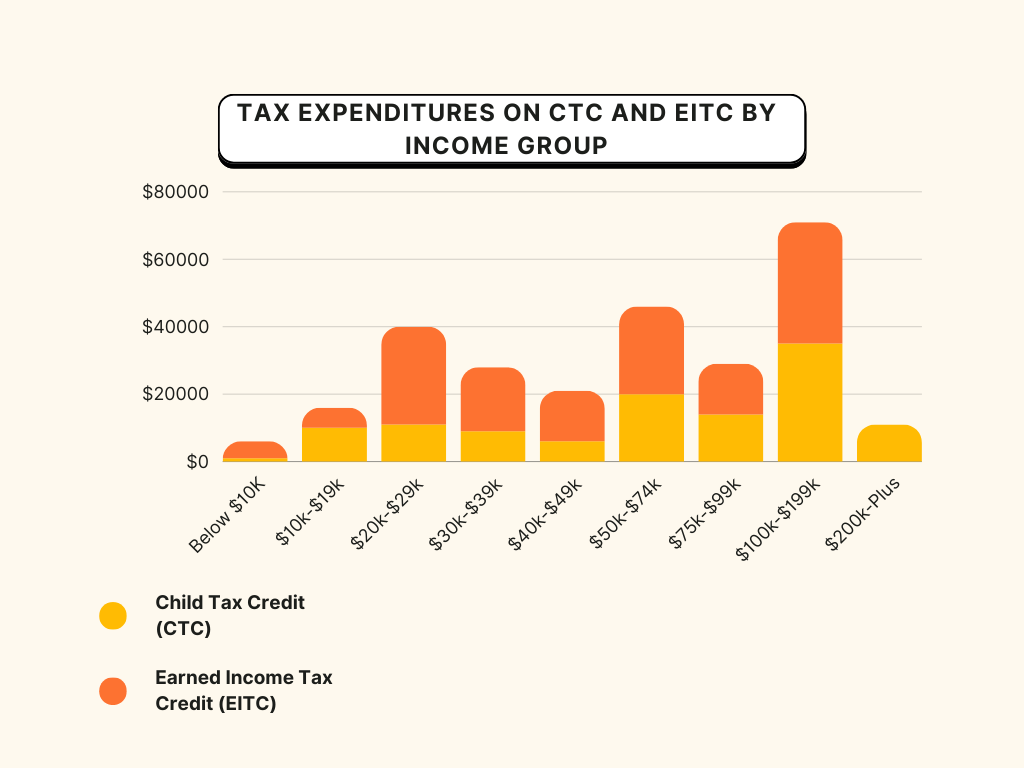

The CTC has been a topic of conversation on the political scene for decades, as Republicans proposed a version of the credit in their 1994 “Contract with America,” which President Clinton again proposed in 1995. It was enacted in 1997 as a $500 refundable credit per child aimed at middle- and upper-middle-income families, meaning that families who owed little or no federal taxes received a check for the full amount. At the beginning of the 2021 tax year, the American Rescue Plan permanently made all families with children in Puerto Rico eligible for the same child tax credit as American families.

The Center on Budget and Policy Priorities reports that U.S. children’s poverty jumped again after the 2021 Child Tax Credit expansion expired. “Renewing this 2021 credit would have kept about 3 million children above the poverty line in 2022— including 975,000 white children, 603,000 Black children, 988,000 Latino children, and 57,000 Asian children—avoiding more than half of the actual jump in the child poverty rate, we calculate using data Census released today,” CBPP President Sharon Parrott stated on Sept. 12, 2023.

Kiplinger, a business/personal finance site, reported data showing that the poverty level increased from 5.2% to 12.4% when families could no longer benefit from the expansion.

Without the expansion, after 2021 the tax code reverted to preventing low-income families with low incomes from accessing the full CTC even as a married couple with incomes up to $400,000 had access to the full amount. “For many families who have experienced discrimination, inadequate schooling, a layoff, or poor health, and for families whose parents work in low-paid jobs like child care or home health care, the design of the Child Tax Credit compounds the inequities they face and does less than it should to help them make ends meet,” Parrott said in her statement.

After the CTC expansion expired at the end of 2021, the CTC returned to a maximum of $2,000 per child and was not available to help all low-income kids because their families’ incomes are too low to qualify. “This includes nearly half (46 percent) of Black children, 1 in 3 Latino and American Indian and Alaska Native children, about 1 in 6 white and 1 in 7 Asian children, and 1 in 3 children in rural counties,” Parrott warned.

In early 2024, the U.S. House of Representatives passed $78 billion tax legislation including expanding the federal CTC, as well as business tax breaks, Kiplinger’s reported.

But the U.S. Senate stalled the bill. Republican senators, in particular, did not like the bill wanted the CTC adjusted for inflation and enabled families to use prior year income to calculate their eligibility, Kiplinger’s added.

Then in October 2024, the Internal Revenue Service announced that the refundable portion of the CTC is $1,700 for the 2025 tax year—meaning the deduction for tax returns filed in 2026. “For the 2024 tax year (returns you’ll file soon, in early 2025), the refundable portion of the credit is also $1,700. For more information about the current child tax credit, see How Much is The Child Tax Credit for 2024?,” Kiplinger reported.

But, it also indicated that politics could change the amounts: “Note: Depending on who wins the 2024 election, the future of the child tax credit could likely experience some changes.”

A Deadlock Over Poverty Solutions

This political deadlock disappointed many families across America and put 5 million of them back into poverty, according to the US Census Reports. The proposed bipartisan tax relief would increase the amount of credit available as a refund over and above the tax liability due. This framework will help families have money back in their pockets during the tax season. If passed, the act could lift 2.9 million children out of poverty.

President Biden highly favors the bipartisan effort to fully fund an effective CTC, as it ties directly into his campaign promises of helping Americans have financial stability, especially low-income families. Kamala Harris is also in favor of a bipartisan act and continuing to give tax cuts to families through the child tax credit which cut America’s child poverty by half.

Leading into the 2024 presidential election, both Vice President Kamala Harris and former President Donald Trump say they support a child tax credit. But the two plans differ.

The Associated Press explained it this way on Nov. 1, 2024: “Vice President Kamala Harris has pitched a major increase to the child tax credit as part of her presidential campaign. Rather than providing the benefit through a tax refund, she wants to send monthly payments to parents, even those who aren’t working and pay no income tax. Republicans have expressed support for increasing the tax credit but also concern that for some parents, it could become an incentive not to work.”

;Many CTC supporters worry that the Heritage Foundation’s “Project 2025” plan, which many believe to be the Trump administration’s blueprint for a second term although he has denied it, would lead to the end of the child tax credit.

Project 2025 calls for the elimination of “most deductions, credits and exclusions,” Forbes reports. Project 2025 critics argue that the elimination of the child tax credit and earned income tax credit could bring large tax increases on low- and middle-income families, even as the wealthy enjoyed reductions.

“Together, these changes to tax rates would mean that a family of four earning $90,000 per year would have paid roughly $2,300 more in taxes last year. If the Child Tax Credit was also eliminated, this family would have paid roughly $6,300 more. Meanwhile, millionaires would pay a lower top tax rate,” Democrats on the Joint Economic Committee of Congress warned.

Trump’s campaign declined to detail his child tax credit plans, indicating that he might “significantly” increase it. A primary concern of Republicans, the AP noted, was expanding it to parents who do not work outside their homes.

Former Gov. Phil Bryant, a conservative Republican who has long supported limits on abortion, told the Youth Media Project in an interview that his party needed to do more beyond blocking abortions. “One of the things that we’re trying to do is to make sure that we take care of the child after birth. Republicans are often criticized as only being concerned with children who are in the womb,” Bryant told YMP in a Zoom interview about gridlock in his party.

Bryant said many politicians should recognize the importance of the CTC. “I remember during the first term of the Trump administration, talking about child care and how we could incentivize that. Look, we spent hundreds of millions of dollars on wasteful things in government,” the former governor said. “But we can’t take care of children. This is just ridiculous. It is. We have to face the reality that there will be single parents and that the mother needs to go back to school or to work to do so. We’ve got to create a safe learning environment for those children.”

Bryant said that it is important for elected officials to face and talk about this issue. “Absolutely, I would support the expansion of CTC and hope whoever is elected president and has control of Congress,” Bryant said.

Parents Feeling the Strain

Mississippi is ranked 50th for our child poverty rate. In 2022, 175,179 children—or 26.4%—in the state lived in poverty. This number is 17.2% higher than the global poverty rate. In Mississippi, more than 20% of those 18 and younger were considered poor by the standards of the child poverty threshold of 2021.

The expiration of the CTC put 3.4 million children back into poverty in the U.S. Since then, many parents and advocates have supported its return. Its provisions provided substantial funds for a lot of low-income households, allowing children to receive the adequate care they needed. The credit mitigated the impact of inflation as well, allowing parents to spend the money on food, clothing and childcare.

Childcare, specifically, exceeds $300 a week on average. The number of children in each household and the quality and location of the establishment play a large role in childcare costs. Since 2022, no CTC bill as large as the one issued in 2021 has been passed due to disagreements on the provisions, such as the work requirement to qualify. The expansion of other welfare programs such as Medicaid have also been hindered over disagreements regarding work requirements.

The work requirement to receive the CTC credit has been particularly burdensome for teen mothers, who, like Brittneyb Barnes, feel the strain of providing for their children without the much needed support. After Nyree Stanford had a baby at 17, she took two different jobs because she did not want to depend on her family for support. Stanford acknowledges that working two jobs while finishing high school and raising a baby is hard for her sometimes, but she said that her mom told her to expect this.

“I had to do what I had to do, and (my mom told me) it’s not going to always be peaches and cream,” Stanford said.

Stanford said she “doesn’t know much about the CTC,” due to it not being available for very long. The primary difference between Stanford and Barnes is that Stanford became a parent in the aftermath of the gridlock that resulted in the death of CTC benefits. The young mom still doesn’t get to spend time with her daughter, which Stanford said “hurts her feelings so much.” With no CTC payment to bolster her income and Congress still deadlocked on the issue, Stanford’s pair of jobs remain the only way for her to make ends meet.